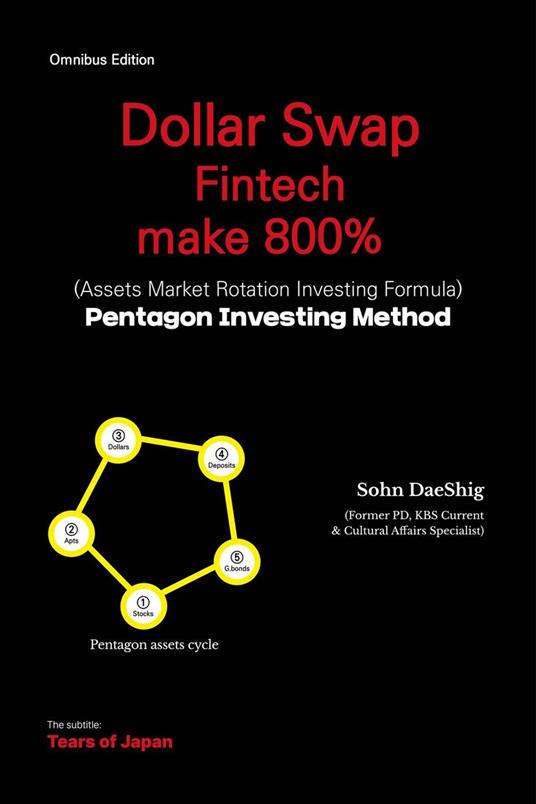

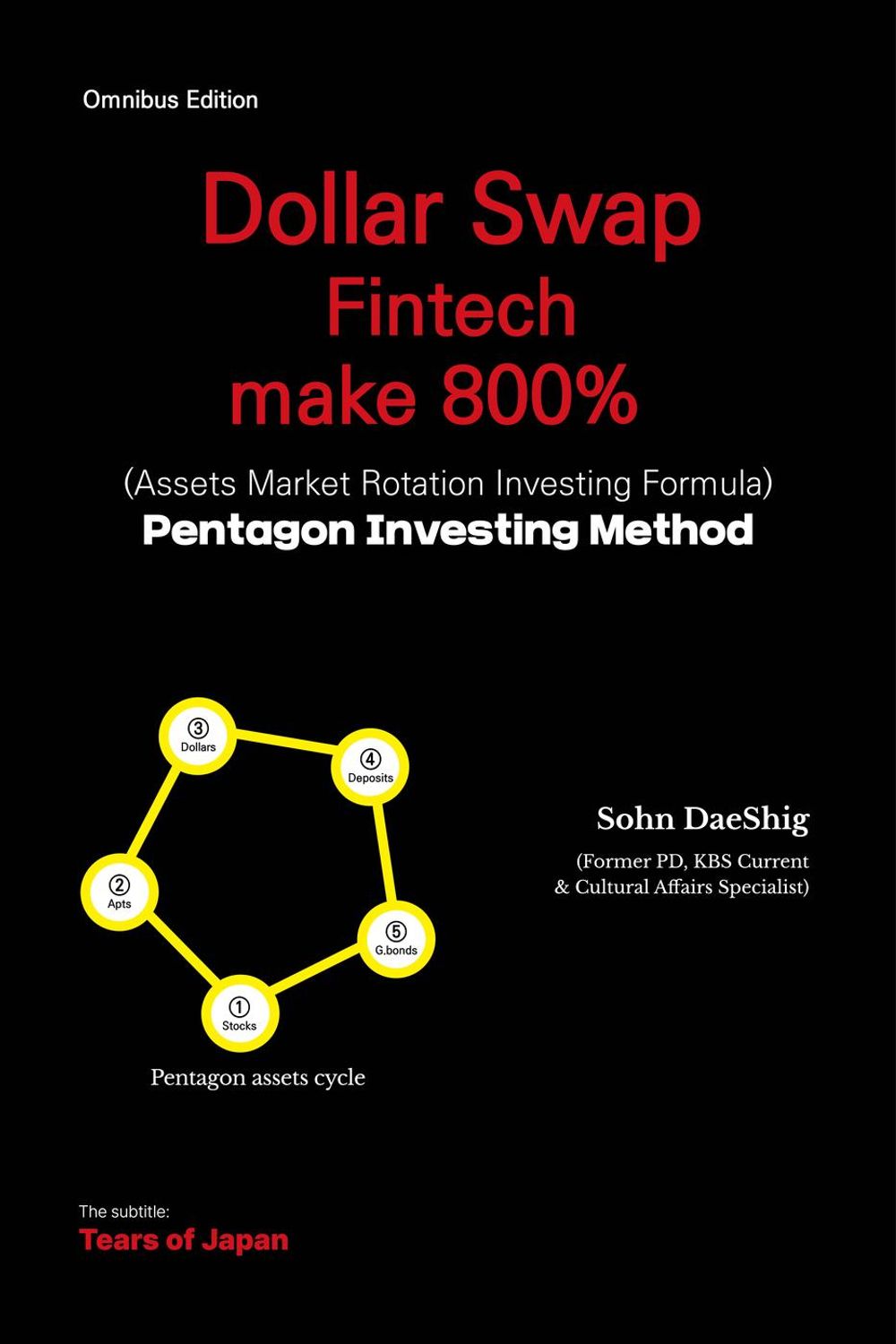

Dollar Swap Fintech make 800% (Assets Market Rotation investing Formula) Pentagon Investing Method.Subtitle:Tears of Japan

Americans and non-Americans should invest differently in assets investing cycle. Depending on where you live, the Fintech(Financial Technology) is completely different. It's a miracle that returns can be up to 800% depending on whether or not you invest in swapping stocks or apts for US dollars. This is the core content of this new book.Title of the book is 'Dollar swap fintech make 800%,(Assets Market Rotation investing Formula)Pentagon Investing Method' People say that long-term investments in stocks and apartments will make anyone rich. But the truth is that 99% of people have failed. So, does that mean Mr.Big Investor is lying? No! He's an American! We are non-Americans.They should invest differently. Outside of the United States. stocks. Apartments. Dollars. Savings and bonds have a strong rotation between the top 5 assets for FinTech that is inevitable.This is because after each rotation, the last asset plummets 50-90% of its price each time. Outside the United States, stocks. apts. Dollars. Savings and bonds should be always invest in the order That's because every time a inter-asset rotation occurs, the price of the asset you invested in just before drops by 50 to 90 percent each time. This is why long term investments in stocks and apts are always doomed. The book provides clear evidence of this.This is the core theory of the Pentagon investment method. Now that we live in an open economy, we need a new theory. Ditch the egg theory of closed economies! We need to move our assets in the order of stocks, apts, dollars, deposits, and government bonds according to the investing formula. This is the investment formula. Pentagon investment method is the new theory, and it is based on the business cycle according to the trade dependence of each country. It is possible to create 1018 times wealth in 10 years by rotating investment assets according to the economic cycle. Few people know about this simple investment theory because it is not in the financial books written by Americans. For U.S. residents, the dollar is always just cash.For non-U.S. residents, the dollar is a monster asset that can suddenly go up and down in price. This means that non-U.S. residents must follow the Pentagon Investment method and rotate between the 5 assets, including dollars and alternatives.You must rotate your money among the 5 assets to be successful. US residents, on the other hand, can only "create wealth" by rotating between the 4 assets. This is a prime example of a hidden story. We Koreans learned in the IMF that when the dollar surges, stocks and apartments plummet.The same is true for Brexit in the UK.Conversely, when domestic stocks and apts are the most expensive, the domestic dollar is the cheapest. You can't create wealth if you don't know how to apply these two facts. When the dollar goes up, stocks and apts go down! This fact has become a new theory. The book also explains why Japan has been growing so slowly, why every asset they invest in loses money, and why the ghost dollar of Japan is coming home to roost. A current and cultural PD who retired after 30 years at KBS, South Korea's public broadcaster, summarizes his 50 years of experience investing in five different assets, including stocks, apts, Dollars, deposits and bonds, from a poor country to a developed one. Out of his entire 50 years of investing, he has spent 30 years studying investing in depth, and this book is about a new investment technique. Now that we've figured out and formalized the reasons why small investors always fail in investing, let's celebrate the fact that making money is as easy as lying down.

-

Autore:

-

Anno edizione:2024

-

Editore:

-

Formato:

-

Lingua:Inglese

Formato:

Gli eBook venduti da Feltrinelli.it sono in formato ePub e possono essere protetti da Adobe DRM. In caso di download di un file protetto da DRM si otterrà un file in formato .acs, (Adobe Content Server Message), che dovrà essere aperto tramite Adobe Digital Editions e autorizzato tramite un account Adobe, prima di poter essere letto su pc o trasferito su dispositivi compatibili.

Cloud:

Gli eBook venduti da Feltrinelli.it sono sincronizzati automaticamente su tutti i client di lettura Kobo successivamente all’acquisto. Grazie al Cloud Kobo i progressi di lettura, le note, le evidenziazioni vengono salvati e sincronizzati automaticamente su tutti i dispositivi e le APP di lettura Kobo utilizzati per la lettura.

Clicca qui per sapere come scaricare gli ebook utilizzando un pc con sistema operativo Windows